Mortgage Lending Market Overview

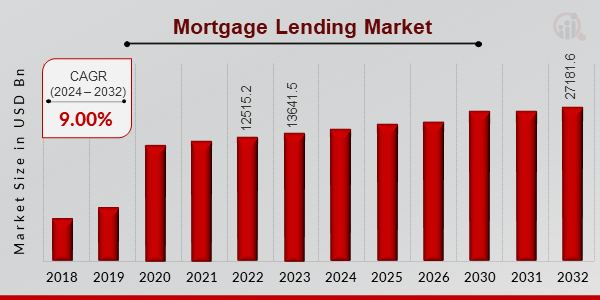

Mortgage Lending Market Size was valued at USD 12515.2 Billion in 2022. The mortgage lending market industry is projected to grow from USD 13641.5 Billion in 2023 to USD 27181.6 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 9.00% during the forecast period (2024 - 2032). Supply and demand dynamics in the housing market directly impact mortgage lending, which is the key market driver enhancing market growth.

Figure 1: Mortgage Lending Market Size, 2022-2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Mortgage Lending Market Trends

-

Growing millennial and Gen Z populations entering prime home-buying years is increasing the market growth

Market CAGR for the growing millennial and Gen Z populations coming into their top domestic-buying years represents a substantial boom motive force for the loan lending enterprise. With these demographic cohorts attaining stages of lifestyles where homeownership will become a concern, there's a heightened demand for loan products. Supportive elements for this trend include the increasing desire for balance and asset accumulation amongst more youthful generations, as well as a shift far from renting toward homeownership. Moreover, improvements in the era and digitalization have made statistics about the home-shopping process more accessible, empowering younger consumers to discover homeownership options and engage with loan lenders.

Additionally, demographic shifts expanded the call for housing alternatives due to urbanization tendencies, performing a critical role in driving mortgage lending increase. As more human beings migrate to urban centers in search of employment possibilities and better facilities, the want for housing in these regions intensifies. Supportive elements consist of the improvement of city infrastructure, along with transportation networks and business centers, which beautify the splendor of urban dwellings. This fashion incentivizes individuals and households to look for mortgages to finance their domestic purchases, thereby fueling a call for inside the mortgage lending market.

Furthermore, government policies and incentives aimed at encouraging homeownership further incentivize capacity owners to take out mortgages. Programs consisting of first-time homebuyer assistance, tax incentives, and subsidies for mortgage lending help lower the obstacles to accessing the housing marketplace. Supportive factors include the promotion of homeownership as a pathway to wealth accumulation and community balance, aligning with broader societal dreams. These tasks not only stimulate demand for mortgages but also contribute to the general increase and stability of the housing market, making homeownership extra potential for a broader phase of the population. Thus, driving the Mortgage Lending market revenue.

Mortgage Lending Market Segment Insights

-

Mortgage Lending Type of Mortgage Loan Insights

The Mortgage Lending Market segmentation, based on the Type of Mortgage Loan, includes Conventional Mortgage Loans, Jumbo Loans, Government-insured Mortgage Loans, and Others. In 2023, the Conventional Mortgage Loans segment dominated the market. Conventional Mortgage Loans offer more flexibility in terms of loan amounts, terms, and eligibility criteria compared to government-insured loans. This flexibility makes them accessible to a broader range of borrowers, including those with higher incomes or substantial assets.

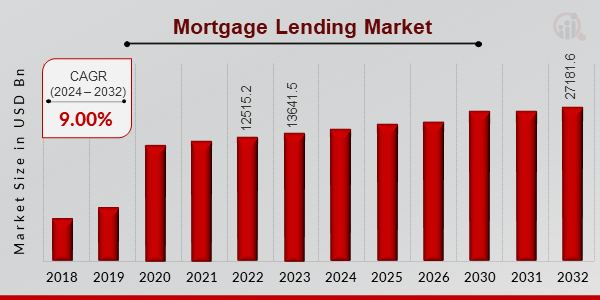

Mortgage Lending Mortgage Loan Terms Insights

The Mortgage Lending Market segmentation, based on Mortgage Loan Terms, includes 30-year Mortgage, 20-year Mortgage, 15-year Mortgage, and Others. In 2023, the 30-year Mortgage generated the most income. The primary reason for the dominance of the 30-year mortgage term is its affordability. By spreading the repayment period over a longer term, borrowers can enjoy lower monthly payments compared to shorter-term loans. This makes homeownership more accessible to a broader range of individuals and families, thereby increasing the demand for 30-year mortgages.

Figure 2: Mortgage Lending Market, by Mortgage Loan Terms, 2023 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Mortgage Lending Interest Rate Insights

The Mortgage Lending Market segmentation, based on Interest Rate, includes Fixed-rate Mortgage Loan, and Adjustable-rate Mortgage Loan. In 2023, the fixed-rate mortgage loan generated the most income. The primary reason for the dominance of fixed-rate mortgage loans is the predictability and stability they offer to borrowers. With a fixed interest rate, borrowers have the assurance that their monthly mortgage payments will remain consistent throughout the loan term, regardless of fluctuations in the broader interest rate environment. This stability appeals to borrowers seeking certainty in their housing expenses, especially in times of economic.

Mortgage Lending Provider Insights

The Mortgage Lending Market segmentation, based on Provider, includes Primary Mortgage lenders [Banks, Credit Unions, NBFCs, and Others], and Secondary Mortgage lenders. In 2023, the primary mortgage lender category generated the most income. Primary mortgage lenders directly engage with borrowers to originate mortgage loans. They establish relationships with borrowers, assess their financial profiles, and underwrite loans based on established lending criteria. This direct interaction allows primary lenders to tailor mortgage products to meet the specific needs and preferences of borrowers, enhancing customer satisfaction and loyalty.

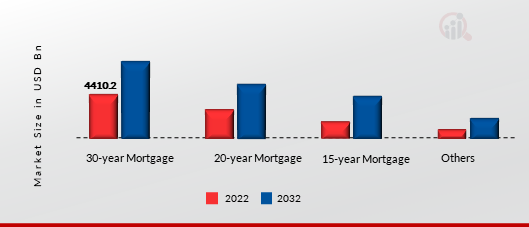

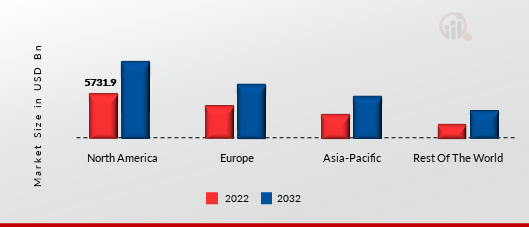

Mortgage Lending Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American Mortgage Lending market area will dominate this market. The overall health of the economy, including factors such as employment levels, income growth, and consumer confidence, influences mortgage lending. A strong economy typically leads to higher demand for mortgages as people feel more confident about making long-term financial commitments.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: MORTGAGE LENDING MARKET SHARE BY REGION 2023 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe Mortgage Lending market accounts for the second-largest market share. European financial institutions continually innovate to offer a diverse range of mortgage products tailored to different borrower needs and preferences. Further, the German Mortgage Lending market held the largest market share, and the UK Mortgage Lending market was the fastest-growing market in the European region.

The Asia-Pacific Mortgage Lending Market is expected to grow at the fastest CAGR from 2024 to 2032. Strong economic growth boosts household incomes, consumer confidence, and purchasing power, driving demand for homeownership. Mortgage lending facilitates property acquisition, contributing to the market's growth trajectory. Moreover, China’s Mortgage Lending market held the largest market share, and the Indian Mortgage Lending market was the fastest-growing market in the Asia-Pacific region.

Mortgage Lending Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their service lines, which will help the Mortgage Lending market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new service launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the mortgage lending industry must offer cost-effective services.

Manufacturing locally to minimize operational costs is one of the key business tactics used by service in the global mortgage lending industry to benefit clients and increase the market sector. In recent years, the mortgage lending industry has offered some of the most significant advantages to households. Major players in the Mortgage Lending market, including Royal Bank of Canada, Federal National Mortgage Association (FNMA), Bank of America Corporation, BNP Paribas, Roostify, Ally, Rocket Mortgage, LLC, Standard Chartered PLC, PT Bank Central Asia Tbk, Mitsubishi UFJ Financial Group, Mr. Cooper, China Zheshang Bank, Clear Capital, Qatar National Bank, Sofi, JP Morgan & Chase, Truist financial corporation, and others, are attempting to increase market demand by investing in research and development operations.

Royal Bank of Canada (RBC) stands as considered one of Canada's biggest and most official monetary establishments, famous for its sizable variety of banking and monetary services. Established in 1864, RBC has grown right into a global powerhouse with a presence in over 40 countries, serving more than 17 million customers globally. As a main varied monetary offerings company, RBC offers a comprehensive suite of products and solutions encompassing non-public and commercial banking, wealth management, capital markets, coverage, and investor offerings. RBC's commitment to innovation and customer-centricity has propelled its fulfillment, income, and recognition as one of the world's safest and most strong banks. With a steadfast focus on handing over exceptional cost and service to its customers, RBC continues to thrive in the ever-evolving landscape of world finance.

Federal National Mortgage Association (FNMA) is a cornerstone of the United States housing finance system. Established in 1938 as a central authority-backed enterprise (GSE), Fannie Mae plays a pivotal role in the secondary mortgage market by supplying liquidity and stability to the mortgage enterprise. Fannie Mae's task centers around expanding admission to cheap mortgage financing for low to moderate-profit households across America. Through its loan-sponsored securities (MBS) and different financial merchandise, Fannie Mae allows the float of capital into the housing marketplace, permitting creditors to originate extra mortgages and borrowers to acquire homeownership aspirations. As a crucial component of the U.S. Housing finance machine, Fannie Mae continues to innovate and adapt to converting marketplace dynamics, assisting sustainable homeownership and financial boom nationwide.

Key Companies in the Mortgage Lending market include

- Royal Bank of Canada

- Federal National Mortgage Association (FNMA)

- Bank of America Corporation

- BNP Paribas

- Roostify

- Ally

- Rocket Mortgage, LLC

- Standard Chartered PLC

- PT Bank Central Asia Tbk

- Mitsubishi UFJ Financial Group

- Mr. Cooper

- China Zheshang Bank

- Clear Capital

- Qatar National Bank

- Sofi

- JP Morgan & Chase

- Truist financial corporation

Mortgage Lending Market Segmentation

Mortgage Lending Type of Mortgage Loan Outlook

- Conventional Mortgage Loans

- Jumbo Loans

- Government-insured Mortgage Loans

- Others

Mortgage Lending Mortgage Loan Terms Outlook

- 30-year Mortgage

- 20-year Mortgage

- 15-year Mortgage

- Others

Mortgage Lending Interest Rate Outlook

- Fixed-rate Mortgage Loan

- Adjustable-rate Mortgage Loan

Mortgage Lending Provider Outlook

- Primary Mortgage Lender

- Banks

- Credit Unions

- NBFC's

- Others

- Secondary Mortgage Lender

Mortgage Lending Regional Outlook

- North America

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 12515.2 Billion |

| Market Size 2023 |

USD 13641.5 Billion |

| Market Size 2032 |

USD 27181.6 Billion |

| Compound Annual Growth Rate (CAGR) |

9.00% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2019- 2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type of Mortgage Loan, Mortgage Loan Terms, Interest Rate, Provider, and Region |

| Geographies Covered |

North America, Europe, Asia-Pacific, and the Rest of the World |

| Countries Covered |

The US, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Royal Bank of Canada, Federal National Mortgage Association (FNMA), Bank of America Corporation, BNP Paribas, Roostify, Ally, Rocket Mortgage, LLC, Standard Chartered PLC, PT Bank Central Asia Tbk, Mitsubishi UFJ Financial Group, Mr. Cooper, China Zheshang Bank, Clear Capital, Qatar National Bank, Sofi, JP Morgan & Chase, and Truist financial corporation |

| Key Market Opportunities |

·Lenders can tap into underserved markets, such as low-to-moderate-income borrowersor minority communities, by offering tailored loan products and outreach programs. |

| Key Market Dynamics |

·Growing demand for diverse loan products |

Frequently Asked Questions (FAQ) :

The Mortgage Lending Market size was valued at USD 13641.5 Billion in 2023.

The global market is projected to grow at a CAGR of 9.00% during the forecast period, 2024-2032.

North America had the largest share in the global market

The key players in the market are Royal Bank of Canada, Federal National Mortgage Association (FNMA), Bank of America Corporation, BNP Paribas, Roostify, Ally, Rocket Mortgage, LLC, Standard Chartered PLC, PT Bank Central Asia Tbk, Mitsubishi UFJ Financial Group, Mr. Cooper, China Zheshang Bank, Clear Capital, Qatar National Bank, Sofi, JP Morgan & Chase, and Truist financial corporation.

The Conventional Mortgage Loans category dominated the market in 2023.

The 30-year Mortgage had the largest share in the global market.